While many investors argue that tech giants’ strong profitability proves there’s no AI bubble, legendary investor Michael Burry has fired back with a sharp rebuttal—drawing eerie parallels to the 1999 dot-com bubble.

Burry’s Counterargument: History Rhymes

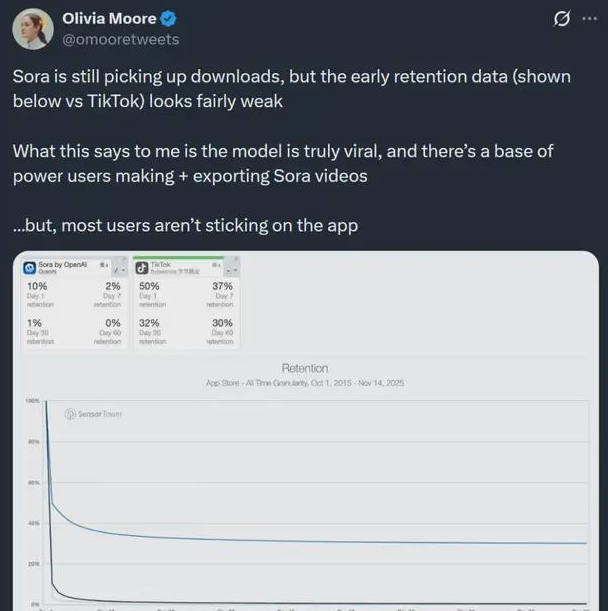

Burry points out that the 1999 Nasdaq peak wasn’t driven by money-losing startups, but by high-margin giants—what he calls the “four horsemen”: Microsoft, Intel, Dell, and Cisco.“Contrary to popular belief, it wasn’t unprofitable internet companies fueling the boom—1999’s soaring Nasdaq was propelled into the new millennium by then-high-margin blue chips…”Today, he argues, the AI craze is similarly dominated by “the five public horsemen”—Microsoft, Google, Meta, Amazon, and Oracle—plus startups like OpenAI. These companies plan to spend nearly $3 trillion on AI infrastructure over the next three years.At the center of it all? Nvidia, which Burry compares to Cisco—the dot-com era’s infrastructure provider whose stock plunged over 75% after the bubble burst.“Once again, there’s a Cisco at the heart of it all—one providing the ‘picks and shovels’ with grand visions. Its name is NVIDIA.”

The Real Bubble: Supply-Side Gluttony

In a November 11 teaser, Burry accused tech firms of artificially inflating profits by extending depreciation schedules.

- •AI chips have a real lifespan of 2-3 years, but some companies depreciate them over 6 years.

- •He estimates this could lead to $176 billion in overstated profits by 2028—with Oracle’s earnings potentially inflated by 26.9% and Meta’s by 20.8%.

In his latest piece, “The Primary Signs of a Bubble: Supply-Side Gluttony,” Burry deepens this critique, framing the issue as “catastrophically overbuilt supply and nowhere near enough demand.”

- •Tech giants are engaged in an unsustainable CapEx binge, pouring billions into data centers and chips—but actual downstream revenue can’t justify the costs.

- •He warns investors not to fall for the “this time is different”fallacy:“No matter how many try to prove it, this time isn’t different.”

Nvidia Strikes Back: “No Systemic Fraud”

Facing Burry’s accusations—and broader AI bubble fears—Nvidia fought back aggressively.

- •Memo to analysts denied claims of 610billionincircularfinancing∗∗,clarifyingthatits∗∗Q3strategicinvestmentswerejust3.7B (total YTD: ~$4.7B).

- •Depreciation & margins? Nvidia blamed higher warranty costs (due to Blackwell’s complexity) and insisted its accounting is proper.

- •No SEC investigation, and crypto volatility doesn’t affect its books.

Some analysts back Nvidia:

- •Raymond James’ Simon Leopold called the “systemic fraud”narrative “inconsistent with fundamentals.”

CEO Jensen Huang dismissed bubble talk:“There’s a lot of discussion about an AI bubble… but from our perspective, we see something very different.”

Burry’s New Business Model: “Knowledge Paywall”

Burry published this scathing analysis in his new paid newsletter, Cassandra Unchained($379/year).

- •The first article, “The Primary Signs of a Bubble: Supply-Side Gluttony,”marks his return to full-time commentary after shuttering his fund.

- •In the “About”section, he explained his shift:“Managing client money came with regulatory constraints that ‘effectively muzzled’ my voice. Those limits are gone.”“Cassandra is unchained.”(Referring to the Greek myth of the prophet ignored.)

Fun fact: After media falsely reported he had 912MshortingNvidia/Palantir∗∗(actualstake:∗∗9.2M), Burry quietly closed Scion Asset Management and teased a November 25 launch of his new project.

The Unpopular Prophet?

Burry ends his piece with a Charlie Munger quote:“If you go around popping a lot of balloons, you are not going to be the most popular fellow in the room.