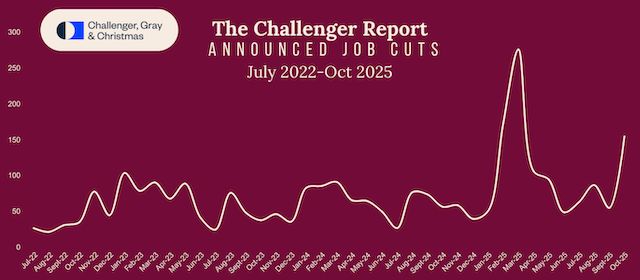

The latest report from employment consultancy Challenger, Gray & Christmas (CGC) reveals that U.S. companies announced 153,000 job cuts in October, a staggering 183% month-on-month surge and the highest single-month total since 2003. Year-to-date, cumulative job cuts have reached approximately 1.1 million, up 65% year-on-year, marking the largest annual layoff tally since the pandemic.

CGC Senior Vice President Andrew Challenger commented: “This is the highest October job-cut total in over two decades. While some industries are correcting post-pandemic hiring surges, widespread AI adoption, weak consumer and business spending, and rising costs are forcing companies to tighten belts, freeze hiring, or reduce headcount.”

Tech Sector Hit Hardest

The report highlights technology, retail, and services as the most affected industries. Tech firms announced 33,300 layoffs in October, nearly six times September’s figure, reflecting acute disruption from AI integration and automation. Consumer goods sector cuts rose to 3,400, while nonprofit organizations impacted by government shutdowns have shed 27,700 jobs year-to-date, a 419% year-on-year spike.

By annual cumulative totals, the top five industries for layoffs—government, tech, warehousing, retail, and services—accounted for over 70% of all job cuts. Challenger noted that reemployment prospects for displaced workers have worsened, with “longer job searches and fewer openings,” potentially widening labor market imbalances and weakening employment growth momentum.

Private Data Fills Gaps Amid Government Shutdown

The report’s release coincides with a U.S. government shutdown due to congressional budget deadlocks, halting official labor market data collection. This has elevated private-sector reports like CGC’s as critical alternative indicators. However, analysts caution against overinterpreting volatility, noting that ADP’s earlier data showed 42,000 net private-sector job gains in October, reversing two months of declines and signaling cautious corporate expansion.

AI Reshapes Labor Demand, Fed Signals December Rate Cut

The layoff surge is closely tied to accelerating AI adoption. CGC emphasized that AI-driven restructuring is altering workforce needs, particularly in tech and media, where large language models are displacing roles—a trend set to intensify in 2025.

Andy Challenger, CGC workplace expert, stated: “The current AI wave mirrors 2003’s industry upheaval—a disruptive technology is redefining job requirements.” With new hiring at multi-year lows, fourth-quarter layoffs could further dampen consumer and economic confidence.

Meanwhile, Federal Reserve Governor Adriana Milan signaled that labor demand remains subdued, projecting a December rate cut: “Based on current data, I expect we will lower rates in December.” Markets price a 62% probability of a 25-basis-point cut, despite recent hawkish remarks from Fed Chair Powell. Most institutions anticipate continued monetary easing if employment weakness persists.

Economic Risks Mount as Layoffs Outpace Hiring

Analysts warn that the convergence of AI disruption, cooling consumption, and fiscal uncertainty is driving “defensive” corporate restructuring. Prolonged reemployment cycles for laid-off workers may delay economic recovery. If layoffs accelerate while job creation stalls, labor market resilience could erode, forcing the Fed to balance slowing growth against inflation risks in the coming months.